does california have an estate tax return

With proper tax planning. California is also known for having state and local governments which are not afraid to tax their populations at rates higher than the national average.

California Waiver Form Fill Out Sign Online Dochub

In fact few states do as of 2021 only 12 states and the District of Columbia impose an estate tax.

. For decedents that die on or after January 1 2005 there is no longer a requirement to file a. California is part of the 38 states that dont impose their own estate tax. May 1 2020.

A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. But one perhaps surprising fact is that. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

However the federal gift tax does still apply to residents. California tops out at 133 per year whereas the top federal tax rate is currently 37. Those states are Connecticut Hawaii Illinois Maine.

In fact California is in the majority here. When you pass away your estate is passed to your heirs or. While Californians pay a number of taxes for many other things luckily we do not have estate or inheritance taxes.

While property managers are often exempt from. If your estate doesnt exceed 117 million it is important to consider giving gifts. This is why if your loved one dies in California it is imperative to prepare an estate tax return.

California does not have an estate tax. Most deceased people have a final income tax return but not everyone must file an estate tax return. The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax.

A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the estate or trust having net income of 100 or more or gross income of 10000 regardless of. Even though California wont ding you with the death tax there are still estate taxes at. If an estate is worth more than 1206 million dollars for single individuals and 2412 million dollars for married couples in.

Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries. This does not necessarily mean that your inheritance will be tax-free. California is part of the 38 states that dont impose their own estate tax.

Despite the many benefits of property managers in California it is crucial to remember that there are certain limitations. Essentially the estate tax is a tax on all of your assets at the date of your death. The state of California does not impose an inheritance tax.

To ensure that the land records properly reflect that the surviving spouse is now the sole owner an Estate Tax Return has to be filed with the Probate Court. The estate tax is a federal tax on the transfer of your property after your death. An estate is a separate entity from the person and it may have different tax.

California is one of the 38 states that does not have an estate tax. The types of taxes a deceased taxpayers estate can owe. California does not have an estate tax or an inheritance tax.

However there are other taxes that may apply to your wealth and property after you die. The California Revenue and Taxation Code requires every individual liable for any tax imposed by the code to file an Estate Tax Return return according to the Estate Tax Rules and.

California Estate Tax Is Inheritance Taxable Income

California Estate Tax Everything You Need To Know Smartasset

Step Up In Basis Capital Gain Tax San Diego Estate Planning Attorneys California Estate And Elder Law Llp

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Will Your Inheritance Get Hit With The California Estate Tax Financial Planner Los Angeles

Moved South But Still Taxed Up North

California Estate Planning Attorney Assistance Cunninghamlegal

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Understanding The Estate Tax Return Marotta On Money

Goofed On Your Tax Return Here S What To Do Los Angeles Times

Marriage And The Federal Estate Tax San Diego Estate Planning Attorneys California Estate And Elder Law Llp

California Estate Tax Everything You Need To Know Smartasset

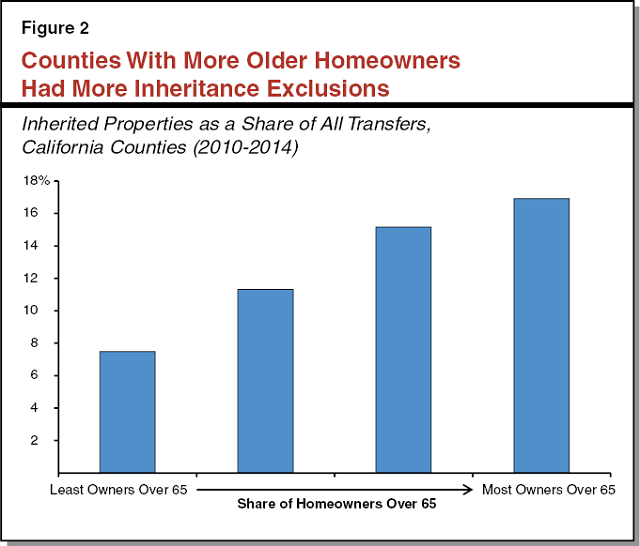

The Property Tax Inheritance Exclusion

Tax And Estate Planning Sacramento Business Attorneys Real Estate Lawyers Healthcare Attorney Labor Law Murphy Austin Adams Schoenfeld Llp Sacramento California Law Firm

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

How Do State Estate And Inheritance Taxes Work Tax Policy Center

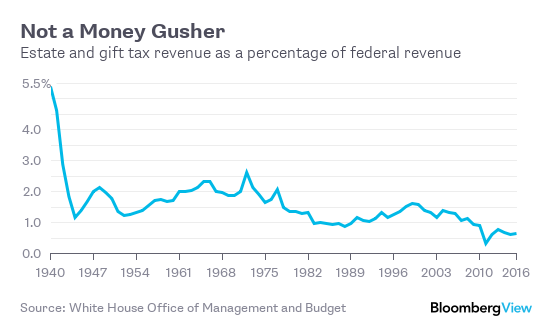

A Defense Of The All American Estate Tax Bloomberg

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Inheritance Tax Here S Who Pays And In Which States Bankrate